21st August 2025

Estimated reading time : 8 Minutes

Payers: Slash Costs with Smart Medical Claims Management

What is Medical Claims Management?

Medical claims management is the process by which health insurance providers (payors) receive, evaluate, process, and reimburse claims submitted by healthcare providers. Each claim includes standardized medical codes—such as CPT, HCPCS, ICD-10, and NDC codes—that correspond to diagnoses, treatments, and healthcare services.

Common Elements of a Medical Claim Include:

- Diagnosis codes (e.g., ICD-10) that indicate the patient’s condition

- Procedure codes (e.g., CPT, HCPCS) that define the care delivered

- Medical supplies and pharmaceutical claims

- Ancillary services such as transportation, if applicable

Payers analyze claims to validate eligibility, assess medical necessity, and determine payment responsibilities. With value-based models gaining traction, many payors now evaluate outcomes alongside services to ensure reimbursement aligns with quality care standards.

According to Grand View Research, the U.S. medical claims processing market is projected to reach $8.5 billion by 2027, driven by the demand for automation. With over 4 billion healthcare claims processed annually—and 20–30% containing errors—inefficiencies in claims processing contribute to $262 billion in avoidable costs each year.

Why Medical Claims Management Matters for Payers

In the evolving healthcare landscape, Medical Claims Management is no longer just an operational function—it’s a strategic advantage for insurance providers or payors seeking to drive efficiency, transparency, and value-based care. For payers, the ability to manage claims accurately and proactively is critical to maintaining financial stability, reducing operational waste, and delivering better patient outcomes. With rising claim volumes, increasing care complexity, and tighter regulatory scrutiny, a robust claims management framework has become indispensable.

Here’s why medical claims management should be a top priority for payers:

1. Ensure Cost Efficiency

Through efficient adjudication processes, payers can significantly reduce administrative overhead, minimize redundant manual workflows, and detect billing discrepancies early in the process. Automation and real-time claim validations reduce the average cost per claim and support faster turnaround times. In fact, according to McKinsey, streamlining claims processing can reduce costs by up to 30% in some payer organizations.

2. Minimize Fraud, Waste, and Abuse (FWA)

Error-free claims, standardized diagnosis codes and procedure codes, and automated data validations play a vital role in detecting anomalies and preventing improper payments. The National Health Care Anti-Fraud Association estimates that fraud accounts for up to 10% of total healthcare spending in the U.S., underscoring the importance of airtight claims processing systems.

3. Enhance Regulatory Compliance

From HIPAA to CMS rules and evolving state regulations, payers face increasing pressure to stay compliant. By enforcing the use of standardized codes, NPI validation, and accurate claim header/claim detail documentation, payers can ensure that every claim aligns with legal and regulatory mandates. This helps avoid penalties, audits, and reputational damage.

4. Promote Provider Accountability

Modern claims platforms allow payers to better monitor patterns in care delivery. When tied to value-based reimbursement models, claims data can be used to incentivize national providers for better care outcomes, adherence to evidence-based guidelines, and reduced unnecessary procedures—thus aligning clinical goals with financial incentives.

5. Streamline Payer-Provider Collaboration

Accurate and timely claim submissions reduce back-and-forth queries, denial appeals, and rework. This fosters better relationships between payers and providers, strengthens contract negotiations, and accelerates the reimbursement cycle—resulting in higher efficiency on both ends.

6. Boost Member Satisfaction

When claims are processed accurately and efficiently—from charge entry to patient statement—it leads to fewer billing disputes, quicker resolutions, and a smoother healthcare experience for members. Improved transparency in benefits, fewer claim rejections, and on-time reimbursements build lasting trust with members and enhance retention.

As the healthcare industry shifts towards integrated, patient-centric care, the ability of payers to leverage medical claims management as a data-driven, strategic function will define their competitive edge. It is not just about processing claims—it’s about creating a robust infrastructure that supports quality, compliance, and cost containment across the continuum of care.

What’s Inside a Medical Claim File?

In the realm of Medical Claims Management, a single claim file is far more than just a billing request—it is a structured, data-rich document that provides insurance providers (or payors) with everything they need to evaluate, process, and reimburse healthcare services efficiently. Each file functions as a critical snapshot of the patient encounter, supporting accurate adjudication, regulatory compliance, and effective decision-making in real time.

Understanding what constitutes a well-structured medical claim file is essential for both payers and national providers. When properly formatted and complete, these files reduce the need for rework, enable faster charge entry and patient statement generation, and lower the risk of errors, delays, and denials.

Key Components of a Medical Claim File:

1. Patient Information & Insurance Eligibility

Includes patient demographics, plan details, and eligibility verification data. This ensures the individual is covered under the plan and determines how benefits should be applied.

2. Provider Details

Captures information such as the National Provider Identifier (NPI), provider address, tax identification number (TIN), and whether the provider is in-network or out-of-network. Accurate provider data supports contract compliance and network management.

3. Claim Header & Detailed Service Itemization

The claim header summarizes the overall claim, while the claim detail provides a line-by-line breakdown of services rendered, dates of service, and corresponding costs. This distinction is critical for streamlined auditing and adjudication processes.

4. Standardized Diagnosis/Procedure Codes

Proper use of diagnosis codes (ICD-10) and procedure codes (CPT, HCPCS) ensures clinical accuracy and alignment with payer policies. These codes also support data analytics, risk adjustment, and population health management initiatives.

5. Date of Service and Charge Entries

Each line item must be tied to a date of service and associated charge entry, giving payors the necessary context for reimbursement decisions and service utilization analysis.

6. Pre-authorization and Referral Data

For services requiring prior approval, inclusion of authorization numbers and referral information is essential to prevent denial of coverage and support care continuity.

7. Historical Encounter References

Chronic care cases and high-utilization patients often require references to past treatments or diagnoses to justify ongoing care. Linking to previous encounters ensures the claim reflects a full clinical picture.

8. Triggers for Member Statement Generation

This component defines when and how the patient statement should be created and delivered, helping payers maintain transparency and enhance the patient financial experience.

A fully structured claim file doesn’t just support financial transactions—it empowers smarter decision-making, fraud detection, and value-based care execution. For payors, investing in systems that can validate each claim element in real-time is no longer optional—it’s foundational. As claim volumes continue to rise and regulatory expectations tighten, understanding and managing the anatomy of a medical claim file will directly impact reimbursement speed, compliance success, and member satisfaction.

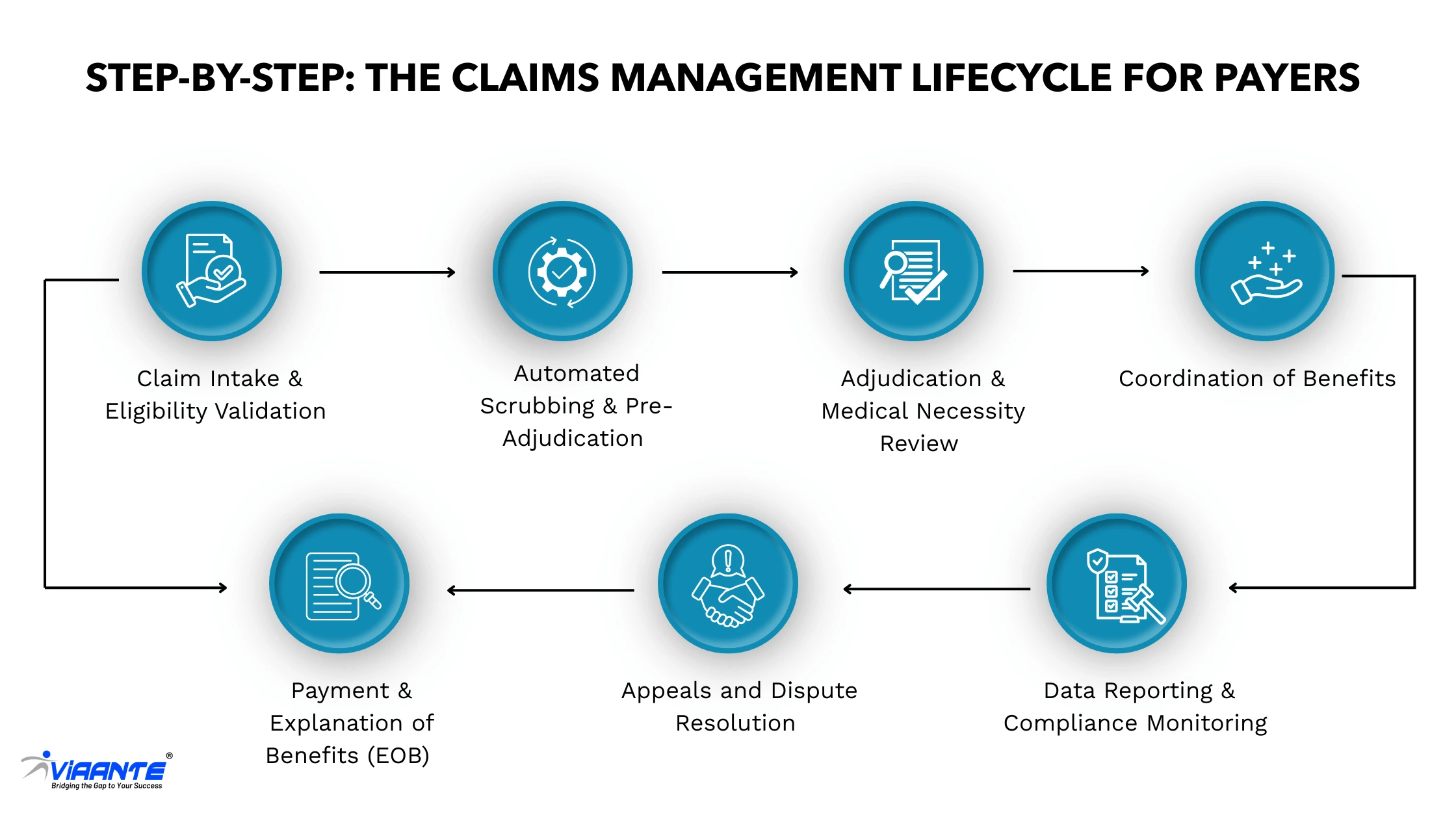

The Claims Management Lifecycle for Payers

Effective Medical Claims Management is not just a back-office function—it’s a strategic pillar for insurance providers or payors striving for operational excellence, regulatory compliance, and improved member experiences. With the healthcare landscape becoming more complex due to shifting reimbursement models, evolving compliance mandates, and growing patient expectations, mastering the claims management lifecycle is more important than ever.

Each claim that flows through a payer’s system represents not just a financial transaction but a data-driven opportunity to ensure quality, prevent fraud, and support value-based care.

Fig. 1 is an illustration of the comprehensive claims management lifecycle for payers, highlighting critical checkpoints and their impact as detailed below:

1. Claim Intake & Eligibility Validation

The lifecycle begins when a claim is submitted by a national provider. During intake, the payer validates member demographics, coverage details, and the provider’s network participation. Verifying insurance eligibility at this stage prevents downstream rejections and denials. Claims missing key claim header information or with outdated insurance details are flagged here.

2. Automated Scrubbing & Pre-Adjudication

Using pre-configured business rules and intelligent automation, claims are “scrubbed” for issues such as invalid diagnosis codes, incorrect procedure codes, and missing documentation. This step ensures that only clean claims move forward, reducing rework and improving adjudication speed. According to CAQH, automation in this phase can cut administrative costs by up to $13 per claim.

3. Adjudication & Medical Necessity Review

The heart of medical claims management, this phase involves matching submitted services to payer policies, checking pre-authorizations, verifying coding accuracy, and assessing medical necessity based on internal and regulatory guidelines. The system reviews each claim detail line item to determine allowed amounts, service coverage, and denial triggers.

4. Coordination of Benefits (COB)

For members with multiple insurance plans, this step determines which payor is primary and what responsibilities lie with the secondary payer. Missteps in COB can lead to overpayments or member confusion. Efficient COB ensures accurate reimbursement and regulatory compliance, especially for government and commercial crossover claims.

5. Payment & Explanation of Benefits (EOB)

Once adjudicated, the claim moves to payment processing. The charge entry amounts are finalized, deductibles/copays are applied, and the provider and member receive an Explanation of Benefits (EOB). The EOB outlines what was paid, what was denied, and why—supporting transparency and enabling the generation of a patient statement when needed.

6. Appeals and Dispute Resolution

Denied or underpaid claims may be appealed by providers or members. This stage requires careful documentation review, turnaround compliance, and fair reassessment. Efficient dispute resolution mechanisms reduce payer-provider friction and mitigate the risk of reputational damage or regulatory penalties.

7. Data Reporting & Compliance Monitoring

At the end of the lifecycle, data from processed claims is captured for internal analytics, CMS reporting, NCQA measures, fraud detection, and process improvement. Payers use this data to refine business rules, adjust policies, and meet evolving compliance standards—all while enhancing efficiency and outcomes across the claims ecosystem.

Why It Matters

Mastering the claims management lifecycle helps payers reduce costs, increase first-pass rates, minimize payment delays, and drive value-based care initiatives. For organizations processing thousands of claims daily, a mature, automated, and analytics-driven lifecycle is not just a best practice—it’s a competitive necessity in modern healthcare administration.

The Role of Clearinghouses for Payers

In today’s digitized healthcare ecosystem, Medical Claims Management would be incomplete without the essential role played by clearinghouses. Acting as intermediaries between national providers and insurance providers (or payors), clearinghouses are the gatekeepers of clean data flow, helping ensure that claims reach the payer in a standardized, compliant, and process-ready format.

For payers, clearinghouses are more than just transaction hubs—they are strategic enablers that improve claims accuracy, reduce administrative overhead, and accelerate the adjudication lifecycle. Given that payers receive millions of claims from providers using a wide variety of practice management systems and EHR platforms, clearinghouses provide the critical infrastructure for standardizing data and optimizing claims intake at scale.

Here’s how clearinghouses support payers in driving efficiency and compliance:

Pre-Screening for Missing or Invalid Data

Before a claim even reaches the payer’s system, the clearinghouse conducts an initial check for essential elements such as diagnosis codes, procedure codes, member eligibility, and NPI validation. This proactive step eliminates basic errors and ensures that claims contain accurate claim header and claim detail information.

Enforcing Formatting Consistency

Different providers often use different formats for claim files (especially in professional vs institutional claims). Clearinghouses standardize submissions into formats compliant with payer-specific requirements and industry standards like ANSI X12 837, reducing the chance of claim rejection due to formatting issues.

Ensuring HIPAA-Compliant Claim Intake

Clearinghouses act as a critical compliance layer, ensuring that all electronic data interchange (EDI) activities meet HIPAA transaction standards. This includes secure handling of patient data, consistent use of standardized medical codes, and reliable system logging for audit readiness.

Routing Claims Efficiently

Once validated, claims are automatically routed to the appropriate payer, business unit, or adjudication team based on predefined logic. Whether it’s commercial, Medicare Advantage, or Medicaid lines of business, this intelligent routing minimizes delays and manual intervention.

Reducing Rework and Accelerating Turnaround

By catching errors early and standardizing claims, clearinghouses drastically reduce the volume of claims that need to be reprocessed or returned. For payers, this translates into faster charge entry, quicker adjudication, and improved timelines for generating patient statements and Explanation of Benefits (EOBs).

Why It Matters for Payers

In a claims environment where even minor errors can lead to costly denials and delays, clearinghouses provide the automation and structure needed to streamline operations. A study by the Council for Affordable Quality Healthcare (CAQH) reports that electronic claims management—enabled largely through clearinghouses—can reduce manual administrative tasks by up to 63% and save the U.S. healthcare system $13.3 billion annually.

For payers seeking to enhance claims throughput, compliance, and member satisfaction, partnering with efficient clearinghouses is not just a convenience—it’s a critical step toward scalable, intelligent, and compliant claims operations.

Managing Denials and Appeals: A Strategic Priority for Payers

In today’s complex and high-volume healthcare environment, effective Medical Claims Management extends far beyond claim intake and adjudication—it includes a robust, proactive strategy for managing claim denials and appeals. For insurance providers and payors, denials are not just a cost center; they represent inefficiencies, knowledge gaps, and missed opportunities to streamline provider collaboration and member experience.

Denials are both pervasive and costly. According to the American Medical Association (AMA), nearly 1 in 10 claims are initially denied, resulting in billions in delayed payments, provider dissatisfaction, and increased administrative burden. Managing this challenge requires a data-driven approach grounded in analytics, process standardization, and technology adoption.

Common Denial Triggers

Payers frequently encounter denials stemming from preventable issues, many of which can be traced back to upstream claim errors or documentation gaps. Common triggers include:

- Improperly coded or unsubstantiated claims: Mismatched diagnosis codes and procedure codes often lead to rejections due to lack of medical necessity or unsupported services.

- Out-of-network providers without prior authorization: Claims submitted by national providers not contracted with the plan, or missing pre-authorization, are prone to denials.

- Non-covered services or experimental treatments: Services outside plan coverage or not recognized by standard medical guidelines often result in denial.

- Duplicate or excessive billing for bundled services: Claims with multiple entries for services already included in a primary code trigger system alerts for overutilization or billing abuse.

Appeals Management: A Critical Touchpoint

Once a denial occurs, managing the appeals process efficiently is critical for regulatory compliance and payer-provider trust. This includes:

- Reviewing supporting documentation and clinical records to validate the appropriateness of care delivered.

- Applying evidence-based policy frameworks to ensure consistency, fairness, and defensibility in decisions.

- Ensuring timely resolution within CMS or state-mandated deadlines to avoid compliance violations, penalties, and reputational risk.

Well-managed appeals also improve adjudication accuracy over time by feeding intelligence back into rules engines and policy design.

Staying Ahead: Denial Prevention & Optimization

Forward-thinking payers are taking a proactive approach to denial prevention through technology and education:

- Denial analytics are used to identify trends by provider, code type, or service line—highlighting areas for provider training or workflow improvement.

- Standardized claim header/claim detail documentation and pre-auth protocols reduce ambiguity and improve first-pass rates.

- AI and machine learning tools are now being deployed to flag high-risk submissions, detect inconsistent coding, and predict denial likelihood before the claim enters the processing queue.

Moreover, automated alerts and dashboards help payer teams intervene in real time, thereby reducing the need for post-submission rework.

Why It Matters

Denial and appeal management is not just a reactive function—it’s a strategic lever in reducing leakage, improving cash flow, and enhancing member satisfaction. For payers, developing a strong denial management framework is essential to elevate the performance of medical claims management operations. It ensures faster charge entry, more accurate patient statements, and stronger collaboration with national providers, leading to better outcomes for all stakeholders.

The Future of Medical Claims Management for Payers

As healthcare delivery becomes more consumer-centric and regulatory expectations continue to evolve, payers are under growing pressure to modernize their approach to medical claims management. The traditional transactional model is no longer sufficient to meet the demands of value-based care, digital interoperability, and rising patient expectations. To remain competitive and operationally efficient, payers must reimagine claims processing as a strategic, data-driven function that supports clinical integration, regulatory compliance, and financial accuracy.

Here’s how payers can future-proof their claims management processes:

Embrace Value-Based Payment Models

The shift away from fee-for-service toward value-based reimbursement has major implications for how claims are reviewed and reimbursed. Payers must:

- Tie payments to measurable outcomes, such as preventive care, chronic disease management, and hospital readmission rates.

- Align claims adjudication protocols with quality benchmarks like HEDIS and NCQA metrics to reward providers for value rather than volume.

- Adapt claims systems to support bundled payments, episode-based reimbursements, and alternative payment models, which require a more nuanced understanding of diagnosis codes, service utilization, and care coordination.

This shift will not only affect payment calculations but also reshape how claim header and claim detail data are interpreted and validated during adjudication.

Strengthen Provider Collaboration

Future-ready payers are building closer, more digital-first relationships with national providers and local health systems alike. To reduce friction and improve outcomes:

- Establish secure data-sharing protocols for eligibility checks, real-time prior authorizations, and procedure code validation before claim submission.

- Build digital engagement tools (such as provider portals and EDI integrations) to facilitate quicker resolution of disputes, documentation requests, and coding clarifications.

- Co-develop standardized billing rules and documentation guidelines, helping providers submit clean claims that require minimal charge entry corrections or manual intervention.

This collaboration not only improves claims throughput but also reduces administrative costs and denial rates, ultimately enhancing both provider satisfaction and member experience.

Leverage Predictive Analytics and AI

As data volumes grow, payers must move from reactive denial management to predictive claim oversight. This includes:

- Using historical claims data to identify patterns in denials, especially related to incomplete or improperly coded claims.

- Leveraging AI and machine learning tools to detect anomalies, such as upcoding, unbundling, or non-covered services, before a claim reaches the adjudication

- Tracking and analyzing KPIs like clean claim rates, average A/R days, and high-risk claims to prioritize resolution, automate corrections, and adjust risk models for population health and cost forecasting.

Predictive analytics doesn’t just support claim accuracy—it also helps payers build proactive strategies for fraud prevention, compliance, and contract optimization.

Why It Matters

The modernization of medical claims management is no longer a technical upgrade—it’s a strategic imperative for insurance providers operating in a high-cost, high-regulation environment. Those who invest in smarter infrastructure, stronger provider engagement, and data-driven intelligence will be positioned to lead in efficiency, compliance, and member satisfaction. The future of claims is faster, cleaner, and smarter—and the time to act is now.

Benefits of Efficient Claims Management for Payers

For payers, efficient Medical Claims Management isn’t just a process optimization—it’s a strategic imperative that directly impacts financial performance, compliance, provider relations, and member satisfaction. As the healthcare ecosystem becomes increasingly data-driven and outcomes-based, modernizing claims workflows offers both immediate and long-term benefits. Efficient claims management transforms traditional administrative functions into value-generating operations that enhance the payer’s position in a competitive market.

Here’s a closer look at the key advantages:

Reduced Administrative Costs and Manual Intervention

By automating routine tasks such as claim intake, data validation, and charge entry, payers can significantly reduce labor costs, eliminate repetitive manual work, and improve scalability. A 2023 CAQH report notes that switching from manual to electronic claims processes can save the industry over $13 billion annually. For payers, this means greater operational agility and more time for strategic work.

Higher Accuracy and Cleaner Claims

Clean claims are those submitted with complete, accurate, and compliant data—reducing the need for rework and denial management. Validating information such as claim header and claim detail fields, checking eligibility, and ensuring correct use of diagnosis codes and procedure codes upfront leads to higher first-pass adjudication rates. This contributes to a more seamless experience for both payers and providers.

Decreased Fraud and Overpayments

An effective claims system can identify duplicate submissions, upcoding, and services that fall outside policy rules—reducing unnecessary spending and exposure to audit risks. AI-powered claims monitoring tools now help insurance providers flag patterns indicative of fraud or abuse before payment is issued, creating a more secure and compliant payment environment.

Faster Turnaround Times and Improved Member Experience

Members expect quick resolutions to their healthcare claims. Efficient claims processing ensures that reimbursements are completed on time, patient statements are accurate, and disputes are minimized. Faster processing also reduces inbound call volumes and support requests, creating a smoother experience across the board.

Improved STAR Ratings and Regulatory Standing

In today’s regulatory environment, performance metrics like STAR ratings, CMS audit results, and HEDIS scores significantly influence payer reputation and funding. Efficient claims handling supports documentation accuracy, timely data reporting, and member satisfaction—three major factors in achieving higher quality ratings and maintaining strong regulatory relationships.

Data-Driven Insights for Operational Optimization

Claims data is a goldmine for performance improvement. With the right analytics infrastructure, payers can extract actionable insights around denial trends, provider performance, service utilization, and care gaps. These insights not only guide internal process enhancements but also inform national provider engagement strategies and value-based contract adjustments.

Why It Matters

In an era of value-based care, consumer-centric healthcare, and increasing cost pressures, optimizing medical claims management is no longer optional—it’s a foundational capability. When executed well, it reduces waste, strengthens provider networks, ensures compliance, and drives better outcomes for payers and their members.

Conclusion: Payers Must Lead the Next Phase of Claims Innovation

Medical claims management has evolved into a strategic function that enables payers to control costs, improve care quality, and meet ever-changing compliance standards. In today’s digital and value-based environment, relying on manual processes is no longer sustainable. To stay ahead, payers must invest in automation, analytics, and closer provider collaboration.

Modern claims operations must ensure clean claim header/claim detail data, accurate diagnosis and procedure coding, and faster adjudication—all while supporting better outcomes and member experiences. Efficiency in processing directly impacts revenue, STAR ratings, and provider satisfaction.

At Viaante, we partner with payers to streamline the entire claims ecosystem—from intake to reporting—with a focus on efficiency, compliance, and continuous improvement. Whether you’re a regional health plan or a national provider network, our tailored solutions leverage automation, deep domain expertise, and data integrity to help you thrive in an increasingly value-driven market.